The Red Button

An emergency break for people in financial distress. In 2021, the Ledger Leopard team helped to develop a proof of concept (POC) for a compassionate, technologically advanced solution known as the Red Button. This solution was designed as a response to the increasing number of Dutch households facing financial distress. Now, in 2024, we proudly announce the transition from pilot phases to real-time implementation across municipalities, bringing relief and support to those in need.

Why the Red Button is a necessity

Financial distress can be a relentless cycle of stress and anxiety for individuals struggling to manage their debts. The Red Button emerged from the urgent need to provide an emergency brake for people overwhelmed by financial obligations, effectively creating a pause on debt collection efforts to allow for a recovery plan to be established.

The benefits of the Red Button

The Red Button solution offers a beacon of hope, providing tangible benefits including:

Citizens

A respite from the constant pressure of debt collection, preserving their dignity and providing time to regroup and plan without the added weight of accruing interest or penalties.

Municipalities

Streamlined coordination of debt assistance, improved social welfare, and reduced administrative burdens.

The role of blockchain technology

Blockchain stands at the core of the Red Button, chosen for its ability to ensure secure, transparent, and private data management. By leveraging a decentralized chain of trust, the solution empowers individuals with control over their personal information while enabling municipalities to interact with data in a legally compliant and efficient manner.

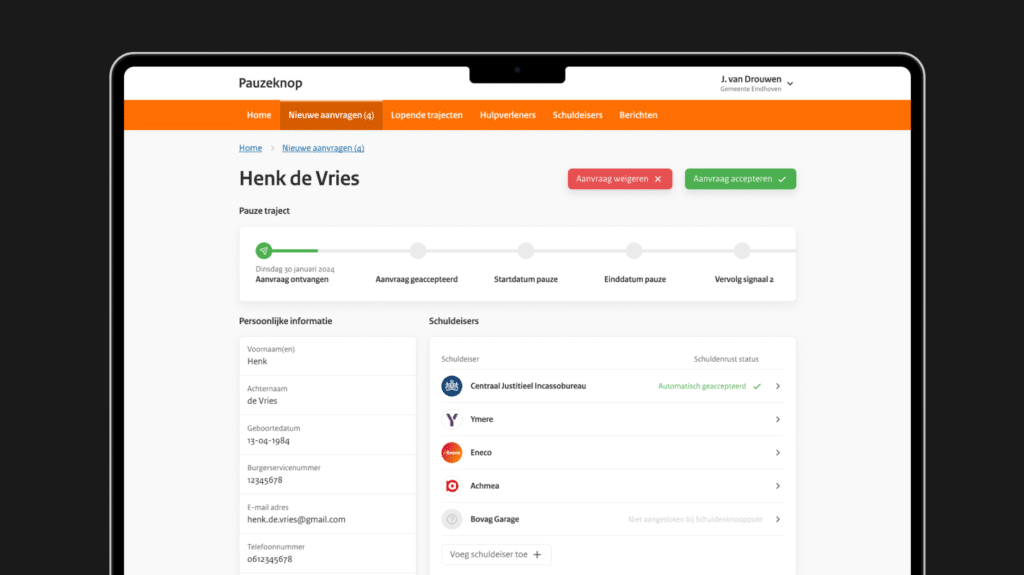

How the red button application functions

The Red Button application operates on the principle of self-sovereign identity and zero-knowledge proofs, allowing users to verify their identity and financial status without disclosing sensitive personal details. With a simple click, it communicates with creditors to halt the debt collection process while a feasible repayment plan is formulated.

The core

The core components of this initiative include:

Efficient debt collection

Improved collaboration among government agencies to streamline and enhance debt collection efforts, ensuring a more organized and empathetic approach.

Online debt visibility

A user-friendly online platform will empower individuals to easily access and monitor all their outstanding government debts, offering greater transparency and control over their financial situation.

Clear communication

The government is committed to implementing clearer and more empathetic communication channels to support those facing financial difficulties.

Innovative pause button

The introduction of an innovative “pause button” will provide individuals overwhelmed by debt with a temporary respite, preventing further escalation due to penalties and interest.

Looking ahead

As we roll out the Red Button solution, we stand on the cusp of a new era for debt management. Ledger Leopard is thrilled to be at the helm of this charge, offering a lifeline to those in financial peril and providing municipalities with effective tools for assistance. Our collaboration with the Dutch government has been pivotal in shaping this initiative, which is part of a larger, comprehensive plan to address and alleviate problematic debts.

This government-led strategy is aimed at enhancing the cooperation among various agencies, preventing individuals from descending into financial hardship, and ensuring transparent solutions for those in debt.

Minister Carola Schouten, responsible for Poverty Policy,

has emphasized the ambition and necessity of these plans, stating:

“Our goal is to break the cycle of debt accumulation and its far-reaching consequences. Too often, individuals with debts to various government agencies find themselves trapped in a complex web.”

As we roll out the Red Button solution, we stand on the cusp of a new era for debt management. Ledger Leopard is thrilled to be at the helm of this charge, offering a lifeline to those in financial peril and providing municipalities with effective tools for assistance. Our collaboration with the Dutch government has been pivotal in shaping this initiative, which is part of a larger, comprehensive plan to address and alleviate problematic debts.

This government-led strategy is aimed at enhancing the cooperation among various agencies, preventing individuals from descending into financial hardship, and ensuring transparent solutions for those in debt.

In the media